Build Wealth with Real Estate Crowdfunding

Get access to high-quality commercial real estate deals whether you’re a retail or institutional investor

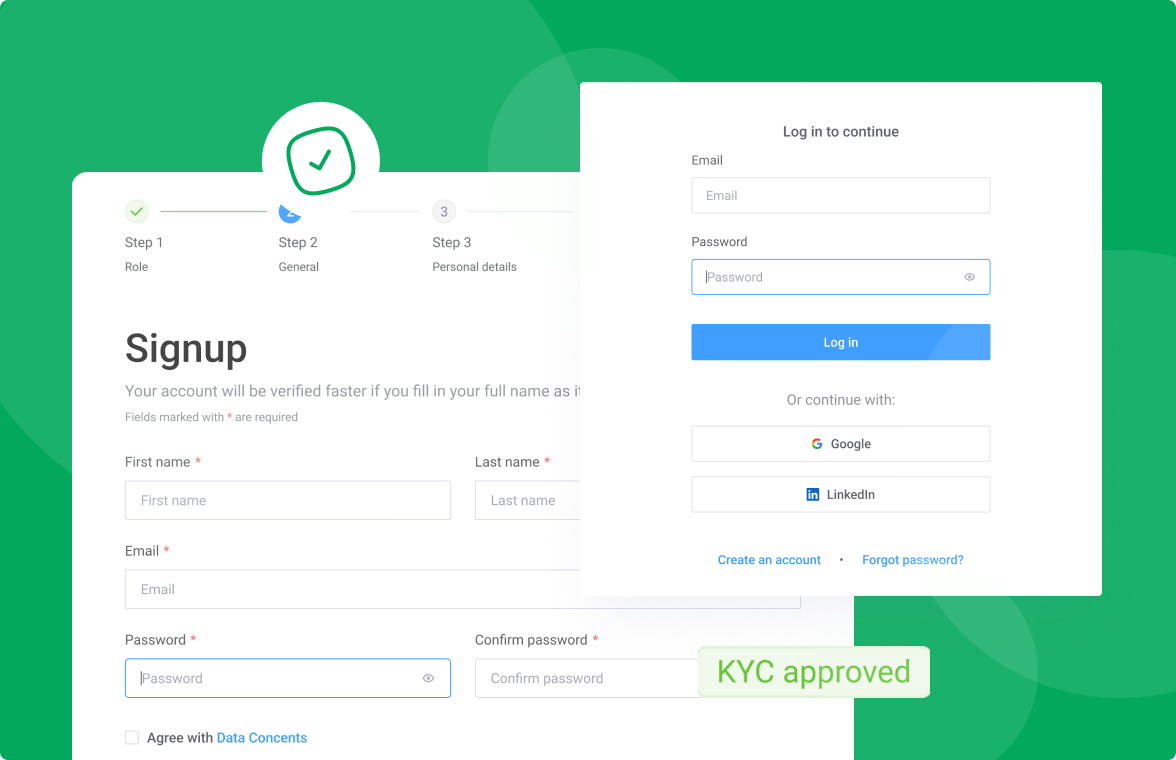

Live opportunities

Discover real estate deals that you can invest in.

Funded opportunities

Investment conditions & platform benefits

Hand-picked

We carefully select projects and co-invest with you because our success is based on your success in the first place.

Institution-grade

Most real estate deals listed in the marketplace are backed by lead investors, so you invest alongside the experts.

Easily accessible

High-quality real estate projects are open for the retail and accredited investors. Anybody who is over 18 years old can invest.

Rewarding returns

Investors collectively fund real estate deals with potential returns of 6-12% a year. Profits are not guaranteed. Capital is at risk.

About us

With over 50 years of real estate finance, private equity, and investment management experience, our team raised capital for projects with the deal size of $40M, $75M, and $100M+ in 2014-2023.

How it works

Register

Create a new account, get verified and gain access to the full platform’s capabilities.

Invest or fundraise

Invest in top-tier commercial real estate deals or pitch your fundraising project.

Reward

Make stable investment returns or fund the project with alternative financing.

Our partners

A brand is not what you tell people it is.

A brand is what people tell other people it is.

We’re here to help you thrive

As much as we love business talk, we also heavily rely on numbers.

2,478

Investors

USD 126M

Raised

94

Projects

Equity

Type

21

Countries

USD 1B

Investing

Community feedback

Don’t take our word for it, see what people and companies say about their real estate crowdfunding experience on our platform.

Elysha Mcphee

Logistics Network

Being an innovative multistorey car park developers in the region, we wanted to try a new approach to financing our projects. To our surprise, crowdfunding delivered better terms and faster financing compared to banks.

Sara Al-Jaber 2

Logistics Network

We raised over SAR 18 million within a week for a warehouse buy-to-let project that we were passionate about. The platform provided full-cycle campaign management while we focused on expanding our business.

Sara Al-Jaber

Logistics Network

We raised over SAR 18 million within a week for a warehouse buy-to-let project that we were passionate about. The platform provided full-cycle campaign management while we focused on expanding our business.

Find all investment conditions for new customers right now?

Latest from blog

Learn more about real estate crowdfunding, investing, and fundraising. Industry trends and latest insights.

Why invest with us?

Our crowdfunding platform has conducted hundreds of deals and repaid thousands of investors.

Read more

Trusted platform

We’ve been on the market for over a decade and always showed high performance.

Read more

Expert team

Our team has decades of experience in due diligence, capital raising and investing.

Read more

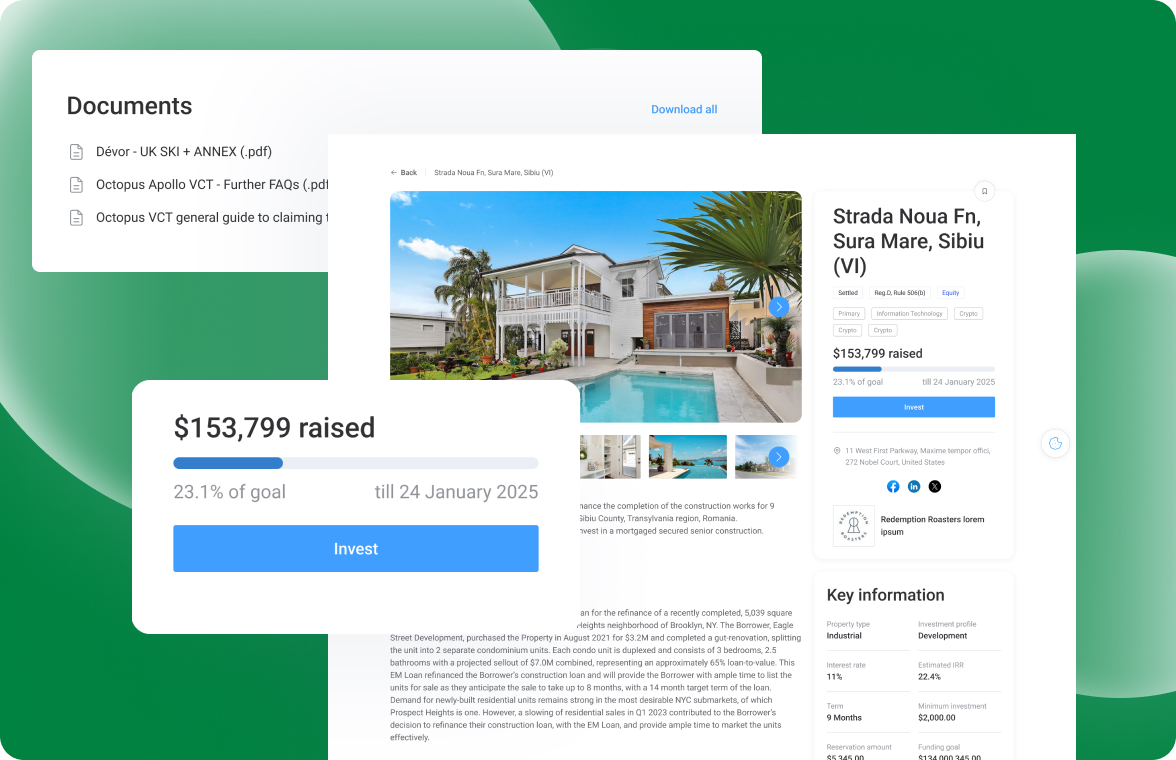

Secondary market

You can exit anytime. Our platform is equipped with a secondary market to improve liquidity.

FAQ

More information about the platform, investing, fundraising, transactions, risks and rewards.